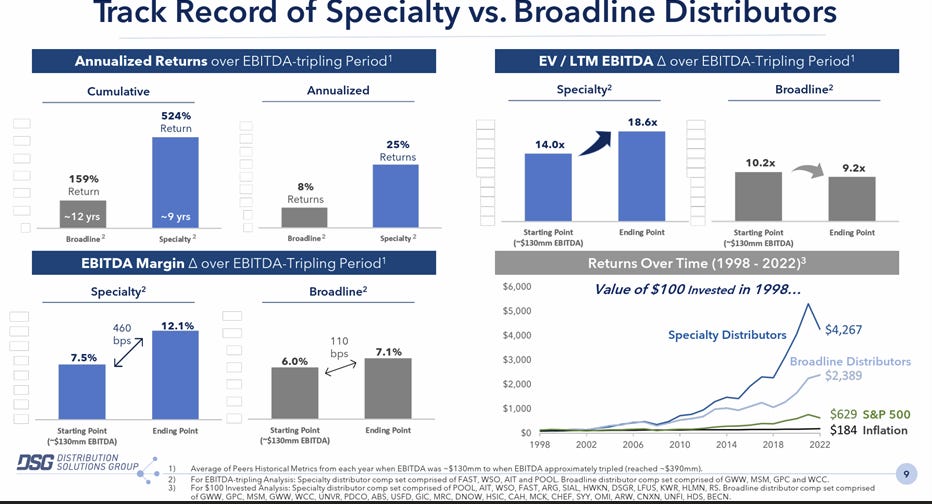

Specialty distributors have consistently outperformed the broad market over long periods of time.

Business Description:

Hillman is a leading provider of hardware-related products primarily to North American retailers. The company sells its products to hardware stores, home centers, mass merchants, pet supply stores, and other retail outlets. Product lines include thousands of small parts such as fasteners and related hardware items, threated rod and metal shapes, key duplication systems and keys, builder’s hardware, personal protection equipment such as work gloves and eyewear, and identification items such as tags, letters, numbers, and signs.

Examples of Hillman Products:

A Durable Moat:

Hillman Solutions differentiates itself from rivals on three interconnected dimensions. First, the company has established sourcing relationships to secure over 110,000 SKUs. For more than 30 years, Hillman has developed and nurtured relationships with manufacturers, primarily in China and Taiwan, for small hardware items like nuts, bolts, nails, screws, and anchors. Second, the company has built proprietary systems and leased 22 distribution centers to support its retail partners with warehousing and logistics for hard-to-manage items. And third, Hillman has evolved its service organization to provide category management solutions, including in-store displays, ID stickers, retail price labels, store racks and drawer systems, assistance in rack positioning and layouts, and inventory and restocking services via a 1,100-person field service and sales team. This value chain fulfills Hillman’s customer-first value proposition and creates what I believe is a durable moat.

Sourcing, Warehousing & Logistics:

Managing over 110,000 small, low dollar value, and high-volume SKUs creates complexity in sourcing, warehousing, and distribution logistics. It requires a different operational set-up compared to managing heavier, bulkier items. For example, Amazon has struggled to successfully use its small item distribution and fulfillment system for larger, bulkier items like furniture. Hillman deploys a hub-and-spoke distribution network (22 DCs reach retail stores within 48 hours) and importantly, bypasses its customers’ distribution centers to deliver products direct to their stores. In comparison, rival Spectrum Brands ships to retailers’ distribution centers rather than direct to stores and does not provide any in-store category management capabilities. The direct-to-store distribution has several advantages for customers, including lower shipping & handling costs, increased speed-to-shelf for products with best-in-class in-stock levels, and more capacity at customer DCs for higher value, easier-to-manage SKUs.

Category Management Solutions:

Not only is managing over 110,000 small SKUs a complex logistical problem, but it also creates customer experience headaches for retailers at the store level. While Hillman’s history dates to 1964, its field service organization has evolved over the last 25+ years as the complexity of managing these categories grew for retailers. Today, Hillman has a 1,100-person field service organization visiting 42,000 stores every couple of weeks to “manage the aisle” by reviewing stock levels, reordering items, providing other merchandising services, interacting with store management, and offering new, innovative products. This reduces labor costs, paperwork, and missed sales for its retailer partners in categories that, according to William Blair, have some of the highest gross margins for retailers likely between 40 and 70 percent. Hillman is deeply embedded in their retailer customers’ operations for what one sell-side firm calls “pain” products.

Primary Concerns:

A key concern for investors is customer concentration. Hillman has two large customers, Lowe’s representing ~23% of fiscal 2020 sales and The Home Depot representing ~ 27%. This customer concentration raises 3 concerns. First, the bargaining power of such large customers assumes a win-lose situation. In other words, Hillman’s profit margins and returns (via high working capital requirements) will be capped. Second, the risk that one or both customers insource (vertically integrates) one or more categories. And third, Hillman will struggle to sustain its historical growth rates as its share within its large customers plateau and finding new categories to grow will be discouraged.

1) As discussed previously, Hillman manages a complex supply chain and logistics operation—one that Lowe’s and The Home Depot are not designed to manage internally. Take for example, the headcap screw (pictured) sold at The Home Depot for $2.36. This is one of ~ 20 billion fasteners and 160 million keys Hillman will sell per year (US households have as many as 30 different Hillman products in them). Hillman ships ~ 365,000 lines a day to customers with the average revenue per line of $8. Its fill rates approach 95-98% compared to the industry average in the 70s. This screw comes in eight different sizes, sixteen different lengths, and can be purchased in ten different package quantities.

The headcap screw is a small ticket item of relatively heavy weight that comes in multiple sizes, lengths, and quantities. It represents a very small part of the overall homeowner project cost. As a result, the consumer needs the item to be in stock and to work. The consumer is not price sensitive. These types of SKUs drive traffic for Hillman’s retail partners, and the retailer enjoys high margins on their sales. Hillman sells over 110,000 “picks and shovels” like this screw by managing the back-to-front complexity of such categories.

Moreover, Hillman owns 90% of the brands it distributes and sells to retailers. So, a Lowe’s or Home Depot could insource these categories and potentially capture incremental profits, but with the incremental costs of carrying huge quantities of small item inventory and additional labor to manage the aisle.

Now, in February 2018, The Home Depot announced the purchase (14x EBITDA) of HD Supply Hardware Solutions (fka: Crown Bolt). Crown Bolt has 20 to 25 percent share of fasteners as 98% of its sales are to The Home Depot. My understanding is Crown Bolt has been completely absorbed by The Home Depot’s culture and operations post-acquisition. Therefore, the ability for Crown to compete effectively with Hillman has diminished. And for reference, Hillman was the vendor of the year at The Home Depot in 2017 and 2020 (and at Lowe’s in 2020 and at The Tractor Supply in 2019 and 2020). Hillman’s sales growth has remained impressively consistent since 2018. And so, while Lowe’s or The Home Depot could insource some or all of the over 110,000 items Hillman distributes and sells, I think the likelihood is low.

2) There’s a risk that Hillman’s lack of bargaining power with two, powerful customers limit its margins and returns. This is a fair criticism. Hillman management may be too optimistic in its goal to reach consolidated adjusted EBITDA margins of 20%. And the company certainly would not want to encourage its scaled retailer partners to insource different Hillman product categories. On the other hand, the physical, human, and digital capital required to support Lowe’s and The Home Depot is a barrier to entry. Hillman carries the inventory. Hillman has the reps in stores managing the aisle every couple of weeks. Hillman’s distribution assets deliver products to stores within 48 hours with 95%+ fill rates. It is fair to be critical of management’s return on invested capital ratio; however, this may have more to do with pandemic effects and management focus (i.e. lack of incentives).

3) There is a concern that Hillman’s customer concentration means its best growth days are behind them. Hillman, however, has an extraordinary record of consist year-in and year-out revenue growth (6% organic revenue CAGR since 2000). The same criticism has been leveled against The Home Depot several times throughout its storied history. A key tenet of compounders is the market underestimating their durable growth (think about how steady Grainger and Fastenal have been for decades). A couple points. One, Hillman did not enter construction fasteners until 2015. Today, the company has 30% share at Lowe’s, 20% at The Home Depot, and 20% at traditional hardware stores. There are existing and new categories for Hillman to leverage its value proposition for continued growth. In addition, M&A will continue to play an important role in driving sales. As I said, organic sales have grown at 6% per year since 2000 (M&A added an additional 4 points to growth). Since 2017, the company has executed seven brand deals for more than $600m. Take, for example, its latest acquisition of Koch Industries announced in January 2024. Koch adds 2,300 new SKUs in a new category, chains, and ropes. I anticipate Hillman will double or triple Koch’s $45 million in annual sales within the next five years.

Historical Financials:

The market tends to underestimate durable growth companies. Hillman has reported positive sales growth in 55 out of 56 years (the exception being 2009 when sales fell 5%). Since 2000, the company’s organic growth as achieved a 6% CAGR (10% including acquisitions).

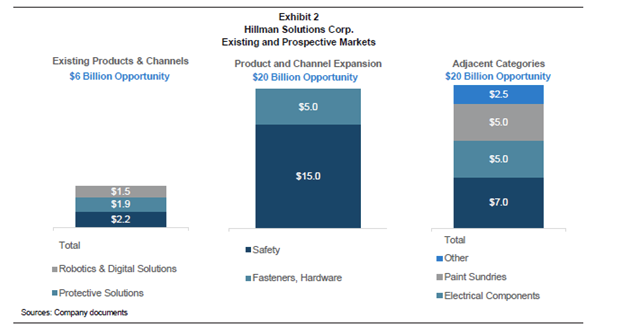

Of course, from 2010 to 2019, the industry has enjoyed sizeable tailwinds, including consistent home price appreciation, steady housing turnover, low interest rates, and uninterrupted economic growth. Now, management believes their sales are tied to repair and remodel trends, i.e. less cyclical. Trends that are expected to generate a +4% industry sales CAGR going forward. These trends include low interest rates, high home values, existing home sales, work-from-home dynamics, millennial home buyers, aging homes, suburban migration, and boomers aging in place. Management’s goal is to increase revenues at 10% per annum (includes M&A) and EBITDA at 15%. And due to scale benefits, cost control and, most importantly, mix shift, management believes EBITDA margins can eventually reach 20%. Hillman self-reports its share at 20% of a $6 billion addressable market (adjacencies and extensions push the addressable market to $20 billion). There are reports indicating the company’s share of hardware solutions as high as 30%, protective solutions 15% and robotics and digital solutions of 13%. Lastly, the company reports its results in three segments: Hardware & Protective Solutions (HPS), Robotics & Digital Solutions (RDS), and Canada. In 2021, HPS reported $1.1 billion in sales at a 12.7% EBITDA margin. RDS reported sales of $250 million at a 29% EBITDA margin. And Canada reported $160 million in sales at an 8.7% EBITDA margin.

Other Concerns:

Besides large, powerful customers like Lowe’s and The Home Depot exerting their scale advantages to limit Hillman’s margins, there is always the risk of commodity cost and labor inflation. Key raw materials include steel, aluminum, zinc, copper and resin-based inputs. Since 2007, Hillman has grown revenues at a 7% CAGR while EBITDA has grown at 9%. In other words, historically, the company has exhibited some operating leverage on sales growth. On the other hand, Hillman’s core business has approximately 13% segment margins, which are far below Fastenal’s best-in-class margins. Further, Hillman sources most of its products from China and Taiwan. A Trump presidency with the potential for a large increase in tariffs presents a risk to margins. And as much as the company might speak to innovation, Hillman spent $3 million on R&D in fiscal 2020 on over $1 billion in sales. The majority of that spend was for the Robotics and Digital Solutions segment. This segment has the risk of obsolescence as traditional keys and fobs are potentially replaced by other technologies tied to smartphones. Then, of course, Hillman is not without competitors like Primesource, Spectrum Brands, Illinois Tool Works and Simpson Manufacturing. Primesource may be the biggest threat, however, my research indicated Primesource has a different focus, a slightly different value proposition, and struggled with pandemic induced supply chain challenges. Lastly, there is a fair criticism of Hillman’s balance sheet leverage, working capital intensity, and poor current return metrics. A former Hillman CEO believes the business can achieve mid-teens returns on invested capital post the disruptions from the pandemic and as sales leverage many investments made in the business over the last half decade to modernize its systems and assets.

Excerpts from Expert Calls:

The difficulty of in-sourcing or competing with Hillman:

“It’s very hard. It’s very hard because even though it seems like some of the products are commoditized, the complexity of having the right SKUs at the right place, at the right time, in the right quantities and managing the distribution network is really where a big part of the value proposition. And to explain that further, you’re doing tons and tons of volume. I’ve been in the industry for 21 years and this this day, there’s no business that I’ve seen or been a part of that has that capability.” --Former President & CEO of Hillman Solutions

“Amazon wouldn’t want to move around these products because these boxes of nails and screws and everything else are heavy and they don’t work with your traditional conveyance. It’s too much volume, too heavy, and too widely distributed. There are many other things they could do that probably would be much easier for their teams to handle and also, they can get higher tickets.” --Former President & CEO of Hillman Solutions

“I don’t see any scenario where at Home Depot or Lowe’s would say, ‘hey, I just want to grab all this business and go direct.’” -- Former President & CEO of Hillman Solutions

Hillman’s service differentiation:

“I computed Hillman’s service level to a lethal brush and broom company where they would come in and service their own aisles, clean everything up, make sure it’s tagged right, everything is where it should be, and inventory was correct or not and then order what they needed. Any time a Hillman guy showed up, I was happy.” --Former Sales Service Manager at Lowe’s

Updating Operations:

The former CEO of Hillman undertook a significant and expansive updating of Hillman’s operations. First, he redesigned the distribution network, including adding capacity and lowering transportation costs. Second, he redesigned the global sourcing organization. The Asia operations had two persons even though Asia was responsible for over 55,000 SKUs. The organization was expanded to 25 persons. The ERP system collapsed from five or six to one during this time. Third, Hillman was doing very little innovation from an engineering standpoint. In 2016-17, management invested heavily in new product innovation. The Power Pro platform is a great example where $2m of undifferentiated products has grown to $75-100m of more differentiated products in the last few years. Lastly, it’s the distribution and service model that commands higher margins for an otherwise fairly commoditized product category.

A message for management:

The most important change the board and management can make to driving shareholder value is updating its incentive structure. It is surprising for a relatively mature business that has significant working capital requirements that ROIC is not a part of the incentive structure. I believe adding a returns’ metric and making it a meaningful portion of management’s compensation would drive improved shareholder returns.

**This is not a recommendation to buy or sell Hillman stock. The report is meant to be a brief overview of the company’s business model and competitive advantages. There is no discussion of valuation. Do your own due diligence.